Conventional monetary establishments which have filed crypto ETF functions have targeted on a specific market (spot or futures). Nevertheless, a current NASDAQ utility means that the asset supervisor Hashdex is taking a distinct strategy, which might be a sport changer within the Ethereum ETF race.

NASDAQ Proposes To Checklist Ethereum ETF

In response to the appliance filed with the US Securities and Trade Fee (SEC), the inventory change plans to checklist and commerce shares of the Hashdex Nasdaq Ethereum ETF, which will likely be managed and managed by Toroso Investments LLC.

Curiously, the fund will maintain each Ether futures contracts and Spot Ether. This transfer from asset supervisor Hashdex is novel, contemplating that different asset managers have both utilized to supply a Spot Ether ETF or Ether futures ETF or filed functions to supply each individually. Nevertheless, Hashdex needs to supply a fund holding each Ether futures contracts and a Spot Ethereum ETF.

The fund’s sponsors consider that combining Ether Futures Contracts and Spot Ether will assist mitigate the chance of market manipulation (a significant concern of the SEC) and supply the market with a “regulated product” that tracks Ethereum’s worth. This fund will assist US traders acquire publicity to Spot Ether with out counting on “unregulated merchandise, offshore regulated merchandise, or oblique methods equivalent to investing in publicly traded corporations that maintain Ether.”

In achievement of the requirement of getting a surveillance-sharing settlement (SSA) for the proposed ETF, Nasdaq acknowledged within the utility that the Chicago Mercantile Trade (CME) will likely be used to trace the worth of Ethereum because the CME represents a “regulated market of great measurement.”

Moreover, the fund is predicted to carry bodily Ether. Nevertheless, the sponsors don’t intend to buy these tokens from “unregulated ether spot exchanges” however from the CME Market’s Trade for Bodily (EFP) transactions.

This transfer is much like Hashdex’s utility to mix a spot Bitcoin ETF with its present Bitcoin futures ETF. Hashdex, in its utility, acknowledged that the CME will likely be used to trace Spot Bitcoin’s worth and that every one Bitcoin purchases will likely be from the CME’s EFP.

ETH kicks off Wednesday on a risky be aware | Supply: ETHUSD on Tradingview.com

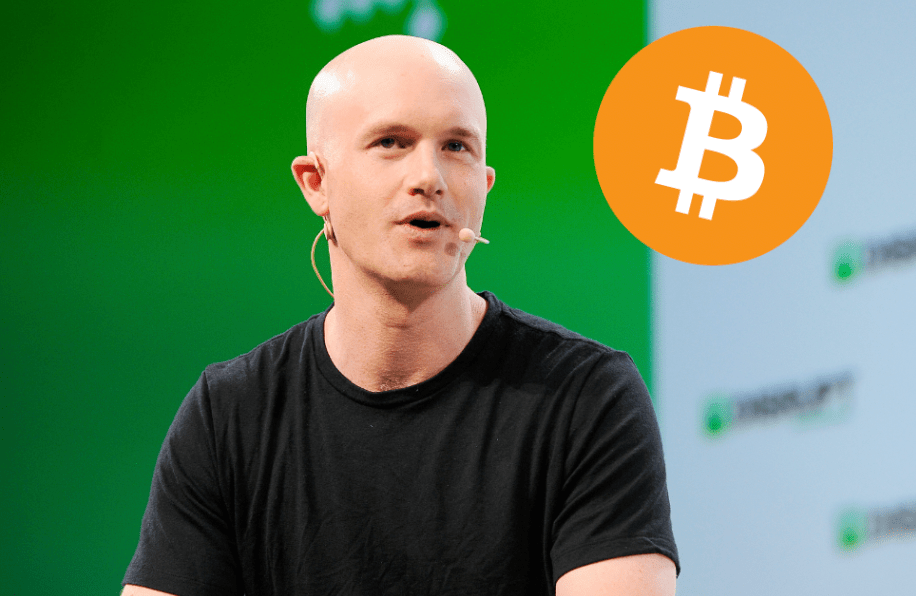

Hashdex Throwing Different Asset Managers Below The Bus?

Nasdaq’s utility mentions the phrase “unregulated spot exchanges” a number of occasions in what appears to be a direct assault on Coinbase and the functions of different asset managers. It’s value mentioning among the different asset managers, together with Ark Make investments, who’ve filed to supply an Ethereum-related ETF, have chosen Coinbase as their custodian.

As such, Hashdex labeling Coinbase as an “unregulated spot change” doesn’t appear proper, as this might undoubtedly affect the SEC’s resolution when coping with these functions.

Moreover, asset managers like BlackRock choosing Coinbase for his or her SSA and custodian had already sparked controversy as many had acknowledged that the SEC wouldn’t be so inclined to approve an utility through which Coinbase is instantly or not directly concerned because it has an ongoing lawsuit in opposition to the crypto change.

Whereas many might commend Hashdex’s “modern strategy,” there’s a have to be cautious of how this strategy may hinder the appliance of others and the eventual impact on the crypto trade usually.

Featured picture from iStock, chart from Tradingview.com