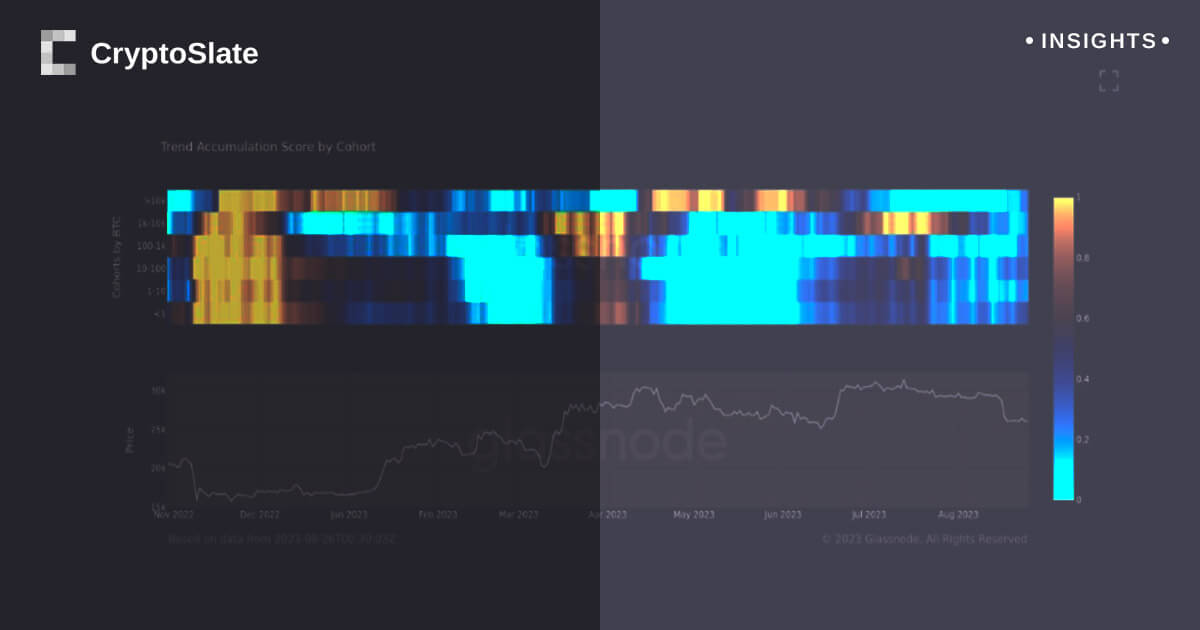

Apecoin has registered a 15% lower in its market worth throughout the final seven days, as per info aggregated by CoinMarketCap. This positions Apecoin as probably the most impacted entity amongst main tasks within the Metaverse panorama, particularly when considered in opposition to a bigger backdrop of the declining cryptocurrency market. A number of elements are driving this downward development, together with vital liquidity outflows in Bitcoin futures markets.

Notable Sale Attracts Consideration to Apecoin’s Volatility

Including to the narrative of Apecoin’s market instability is a selected sale that has caught the eye of trade analysts and buyers alike. A outstanding Apecoin pockets holder, who initially invested 749 ETH—equal to roughly $2 million on the time of buy—on Might 1, 2022, to amass 96,276 models of APE at $21 per unit, determined to liquidate their total place not too long ago. This transfer materialized at a promoting worth of simply $1.51 per APE token, leading to a staggering lack of round $1.5 million for the investor.

The divestment additional questions the soundness and future prospects of Apecoin, as it might signify waning confidence amongst vital stakeholders within the mission. Such high-profile exits might doubtlessly catalyze a ripple impact, discouraging potential new buyers and shaking the religion of present token holders.

Exercise Metrics Present Alarming Drop

Carefully aligned with its plummeting worth is a noticeable contraction in Apecoin’s general person engagement. Each the variety of lively Apecoin wallets and the amount of each day transactions have proven vital decreases. Whereas it’s troublesome to straight hyperlink this decline in person exercise with the falling worth, it’s a growth that can not be ignored. Decrease engagement metrics are sometimes seen as a warning signal of dwindling community utility and person curiosity, which, in flip, can exacerbate market volatility.

It stays to be seen whether or not Apecoin can reverse this adverse development and regain its place as a frontrunner within the Metaverse area. With a market now marked by skepticism, reaching a rebound could require concerted efforts, together with clear communication from the mission’s management and probably the roll-out of latest options or partnerships that would rejuvenate stakeholder curiosity.

To summarize, Apecoin’s current market efficiency has been lower than favorable, characterised by a 15% drop in worth, a major sell-off from a notable pockets holder, and declining exercise metrics. These developments collectively highlight the mission’s present challenges, warranting eager commentary for any indicators of restoration or additional descent.