Fast Take

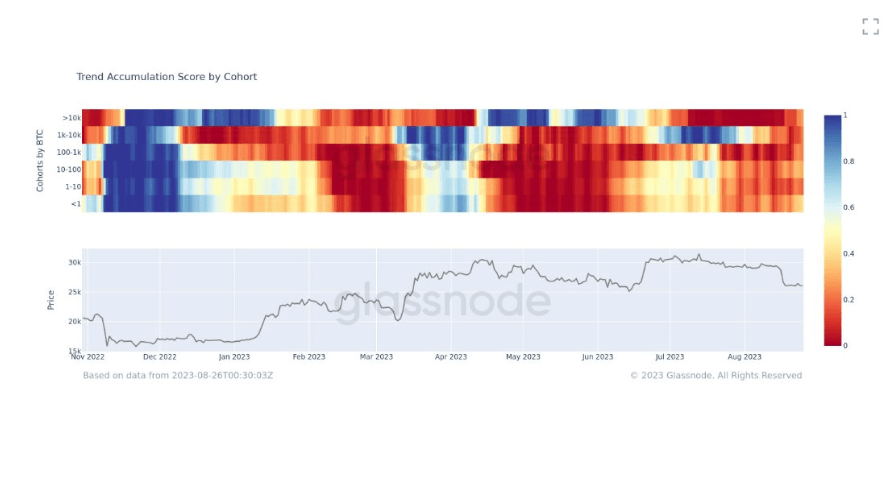

The Accumulation Pattern Rating, created by Glassnode, affords an in depth breakdown of the cryptocurrency acquisition conduct of various entity pockets cohorts. The algorithm calculates this rating by evaluating the dimensions of those cohorts and the amount of Bitcoin they amassed over the last fortnight. A rating nearer to 1 implies that the entities in that cohort primarily accumulate cash, whereas a rating nearing 0 suggests a predominant distribution of cash inside the cohort.

Bitcoin has dropped roughly 11% in August, hovering round $26,000. Nonetheless, the Accumulation Pattern Rating signifies a marked paucity in accumulation from any cohort. This remark is supported by the visualization’s crimson hue, signifying that the majority cohorts had been distributing cash fairly than accumulating. It’s vital to notice that sure entities, together with exchanges and miners, are excluded from this calculation to make sure an unbiased analysis of the market sentiment amongst completely different cohort contributors.

The stagnation within the accumulation pattern, mirrored within the distribution-dominant conduct of the cohorts, underscores the market’s conservative stance in Bitcoin buying and selling throughout August.

The publish Bitcoin accumulation sees slowdown amid August market downturn appeared first on CryptoSlate.